How to Complete the ACORD 130 Workers Compensation Application

The Total Estimated Annual Premium - All States section is the 5th section down on the ACORD 130.

The numbers you enter here come from the Premium Section on page 2. If you are using Cap Dat ACORD forms these fields will automatically fill once you have completed the Premium Section on Page 2.

TOTAL ESTIMATED ANNUAL PREMIUM: The important word here is "estimated". Workers compensation premiums are subject to audit and adjustment based on the actual payroll during the policy premium.

TOTAL MINIMUM PREMIUM: Each workers compensation class code has its own minimum premium that will be charged regardless of the actual result of the rate times the payroll. You enter the highest minimum premium for any individual class code on this policy in this space.

TOTAL DEPOSIT PREMIUM ALL STATES: This is the amount you need to collect from your customer to send in with the application. Check with your company on payment plans. Each company's payment plans will have their own minimum deposit amount.

If your carrier does not have a payment plan option, consider offering a premium finance option to your customer. In many states your agency may be able to receive some additional revenue from a premium finance company for placing customers with that specific premium finance company. Something to think about.

I hope this helps you learn how to complete the ACORD 130 workers compensation application.

We all learn things for the first time at some point. Please fell free to share.

Wednesday, April 30, 2014

Tuesday, April 29, 2014

ACORD 130 Workers Compensation Section - Policy Information

How to Complete the Policy Information Section of the ACORD 130

Policy Information

PROPOSED EFF DATE: The proposed effective date for this policy. For data entry purposes most online forms will force you to use a database friendly format. Cap Dat ACORD forces DD/MM/YYYY. Example 01/01/2014.

PROPOSED EXP DATE: The proposed expiration date for this policy. For data entry purposes most online forms will force you to use a database friendly format. Cap Dat ACORD forces DD/MM/YYYY. Example 01/01/2014.

NORMAL ANNIVERSARY RATING DATE: This will most likely be the same as the proposed effective date. The rating date is important for when any appropriate rating bureau would calculate an experience modification. Reasons the dates might not be the same could be purchase of insured by another company or mid term cancellation by a previous insurance carrier.

PARTICIPATING OR NON-PARTICIPATING: (Quoted from the ACORD FIG) A Participating policy may result in reduced premiums through the payment of policyholder dividends declared by the insurer. Some policyholder dividends are based on actual experience of the applicant. If such a program is available through the company in the covered state, indicate whether the policy is to be on a Participating or Non-Participating basis. Check with your company on the availability of plans.

RETRO PLAN: This is a retrospective rating plan. It means that, subject to minimum and maximum premiums, the final actual premium will be computed after the policy period based on actual payroll and actual losses.

PART 1 - WORKERS COMPENSATION (STATES): Part 1 refers to the state by state workers compensation laws. List all states in which workers compensation is provided by this policy. Use the Remarks section at the bottom of page 2 if more space is needed.

PART 2 - EMPLOYER'S LIABILITY: Enter the limits for EACH ACCIDENT, DISEASE-POLICY LIMIT, DISEASE-EACH EMPLOYEE. Check with your underwriter to see what limits apply in each state.

PART 3 - OTHER STATES INS: Part 3 refers to states not listed in Part 1, but where your customer is likely to have operations at some point during this policy term.

DEDUCTIBLES (N/A IN WI): Check with your underwriter or an experienced agent in your office to see if deductibles apply in the states for which workers compensation coverage is being provided. These check boxes are not mutually exclusive. The third check box with no text is for any other deductible type.

AMOUNT / % (N/A WI): Enter the percentage amount or the hard dollar amount of the deductible. Example 1% or $1,000. Choose one format or the other. Check with your underwriter to see which applies, if any.

OTHER COVERAGES: Check all that apply.

U.S.L&H - United States Longshoremen's and Harbor Workers coverage

VOLUNTARY COMP: Voluntary Compensation

FORGEIN COV: Foreign coverage

MANAGED CARE OPTION

DIVIDEND PLAN/SAFETY GROUP: This is related to Participatory Plans. Check with your underwriter to get name of group.

ADDITIONAL COMPANY INFORMATION: This is a wide open area with anything else the company feels needs to be listed.

SPECIFY ADDITIONAL COVERAGES/ENDORSEMENT (ATTACH ACORD 101, ADDITIONAL REMARKS SCHEDULE, IF MORE SPACE IS NEEDED.): Anything you need on the policy, or endorsements you need to be issued with the policy should be listed here.

I hope this helps you better understand how to complete the ACORD 130 Workers Compensation Application.

Please share this with anyone you wish.

Monday, April 28, 2014

ACORD 130 Workers Compensation Application - Locations Section

How to Complete the Locations Section in the ACORD 130 Workers Compensation Application

The Locations section has room for only three locations. What if you have more? Use the Remarks section at the bottom of page 2. If that is still not enough use the ACORD 101 Additional Remarks Schedule.

LOC# - This means Location number in plain English. Use numbers 1, 2 and 3. Not Letters.

HIGHEST FLOOR - I have no idea why they ask this question. I suppose the risk of steps or jumping. Anyway, this is just the number of the highest floor at the location. Whether your customer is on that floor or not is not asked. I would add this to the Remarks Section at the bottom of page 2.

STREET, CITY, COUNTY, STATE, ZIP CODE - While ACORD has done an admirable job here of not using abbreviated words, They have made a mess of data entry. At a minimum just use a 2 character entry for STATE - NC instead of North Carolina.

I hope this helps you learn how to correctly complete the ACORD 130 Workers Compensation application.

Please feel free to share.

Friday, April 25, 2014

ACORD 130 Workers Compensation Application Status of Submission and Billing / Audit Section

The Status of Submission and Billing/Audit Information section of the ACORD 130 is the second major block from the top of the first page.

BILLING PLAN:

The Agency Bill option means your agency is responsible to the carrier for the premiums and your customer is responsible to you for the premium. You will have to issue the invoices and collect the premium. If you cannot collect the premium, depending on your carrier / agency contract, you may just be out this money and receive no help from your carrier.

The Direct Bill option means the carrier bills the customer directly. They are responsible for invoicing and collecting. If the customer does not pay, your agency is not liable for that amount. In fact, you may even still get paid your commission on the policy.

PAYMENT PLAN:

Annual, Semi-annual, Quarterly are all mutually exclusive options. Check to box that applies.

The box with no text beside it is for you to enter any other billing plan. For example, some plans are monthly, some are monthly reporting, etc.

The % Down is asking for you to enter the percentage of the total estimated premium the customer is paying you upon the policy going into effect.

AUDIT:

Workers compensation premiums are based on payroll. Payroll is estimated when the policy is issued or quoted. But the carrier reserves the right to audit the actual payroll and revise the premium.

Check the box for the audit time period the carrier will use for this policy. For smaller policies this will mostly be AT EXPIRATION.

These boxes are mutually exclusive. Check only one.

The check box with no text next to it is for any other audit period not listed by the other check boxes.

I hope this helps you in learning how to complete the ACORD 130 Workers Compensation Application.

We all learn things for the first time at some point. Please share this as often as you wish.

STATUS OF SUBMISSION

The Status of Submission has 4 check boxes. These are not mutually exclusive.

QUOTE: Check this if all you are asking for is a quote.

ISSUE POLICY: This is telling your underwriter to go ahead and issue the policy even before they tell you the cost. If you show a policy status of BOUND, you should also check the ISSUE POLICY box.

BOUND: Check this if you have bound the policy. Be certain your agency has binding authority for this line of business with the carrier on whom you are binding the coverage. If you are uncertain, call, email or text your underwriter. Binding a policy means you have legally put coverage in force. Even if the carrier does not give you this authority, the carrier is likely now on this risk and will have to issue notice of cancellation to get off this risk.

ASSIGNED RISK: Notice, if you check this box you also need to complete the ACORD 133 form. States provide Assigned Risk pools to provide workers compensation to businesses insurance carriers do not wish to write on a voluntary basis. Since Workers Compensation laws require businesses with 4 or more employees to carry Workers Compensation insurance, each state provides the Assigned Risk pool as a market of last resort. The price charged to a business insured in the assigned risk pool is higher than the price charged to the same business if they found insurance coverage outside of the assigned risk pool.

BILLING / AUDIT INFORMATION

BILLING PLAN:

The Agency Bill option means your agency is responsible to the carrier for the premiums and your customer is responsible to you for the premium. You will have to issue the invoices and collect the premium. If you cannot collect the premium, depending on your carrier / agency contract, you may just be out this money and receive no help from your carrier.

The Direct Bill option means the carrier bills the customer directly. They are responsible for invoicing and collecting. If the customer does not pay, your agency is not liable for that amount. In fact, you may even still get paid your commission on the policy.

PAYMENT PLAN:

Annual, Semi-annual, Quarterly are all mutually exclusive options. Check to box that applies.

The box with no text beside it is for you to enter any other billing plan. For example, some plans are monthly, some are monthly reporting, etc.

The % Down is asking for you to enter the percentage of the total estimated premium the customer is paying you upon the policy going into effect.

AUDIT:

Workers compensation premiums are based on payroll. Payroll is estimated when the policy is issued or quoted. But the carrier reserves the right to audit the actual payroll and revise the premium.

Check the box for the audit time period the carrier will use for this policy. For smaller policies this will mostly be AT EXPIRATION.

These boxes are mutually exclusive. Check only one.

The check box with no text next to it is for any other audit period not listed by the other check boxes.

I hope this helps you in learning how to complete the ACORD 130 Workers Compensation Application.

We all learn things for the first time at some point. Please share this as often as you wish.

Thursday, April 24, 2014

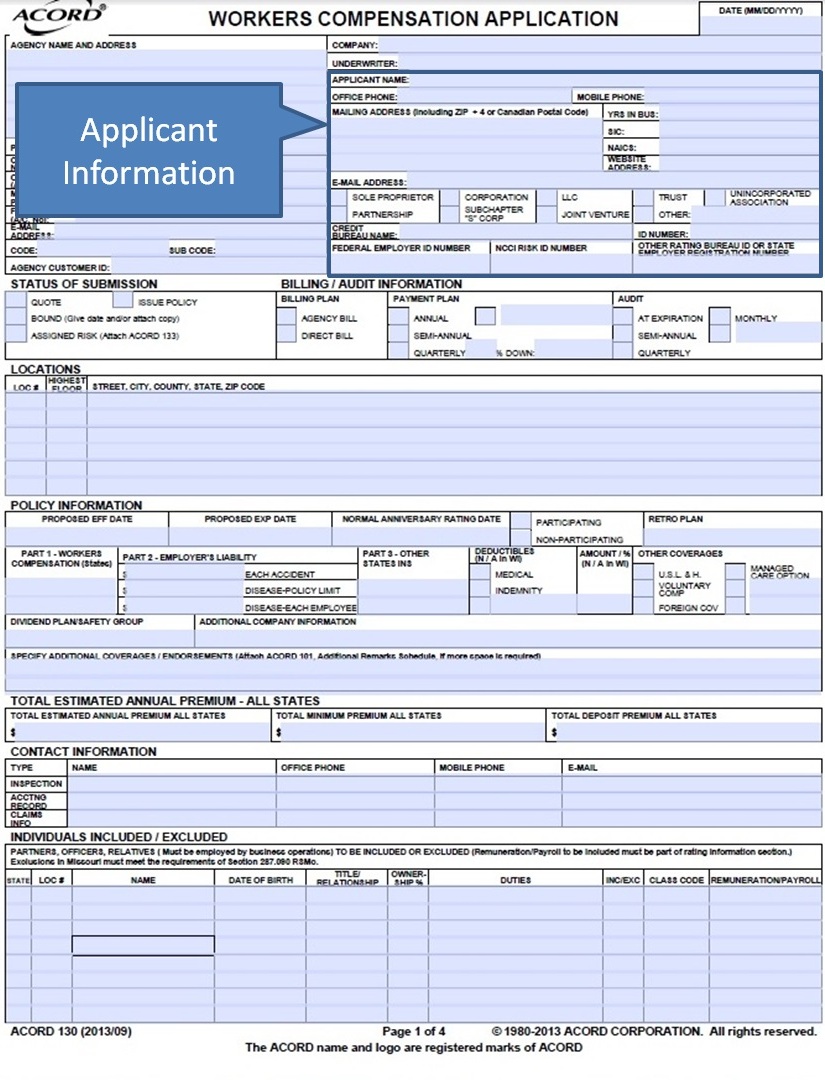

ACORD 130 Workers Compensation Application Applicant and Carrier Information

Part 3 How to Complete a Workers Compensation Application

The Carrier and Applicant information is in the top right hand corner of page 1 of the ACORD 130.

Carrier Info

COMPANY NAME: This is the name of the specific insurance carrier to whom you are sending the application.

UNDERWRITER: This is the name of the actual underwriter at the carrier to whom you are sending the application. You may not know this person's name.

Applicant Information

APPLICANT NAME: The full legal name of your customer as you need to have it show on the issued policy. Remember, this is how the name will appear on certificates of insurance and driver ID cards.

OFFICE PHONE: The main phone number for your customer's business.

MOBILE PHONE: If you have the person's permission, this would be the mobile phone number that the carrier's inspection staff could use to call your customer. Be certain you have your customer's permission.

MAILING ADDRESS: Post Office Box or street address in full. Includes the city, state and zip code. Normally you would fill this box in the so it looks just like you want it to look on an envelop. Example:

Atlatl, Inc.

P.O. Box 2936

Durham, NC 27715-2936

YRS IN BUS: In plain English this means years in business. You can put a hard number here or you can put the year the business opened. Then you do not have to change it every year at renewal. Example:

4 years 3 months

or,

Since March 2003

SIC: This stands for Standard Industrial Classifications. This is a system created by the U. S. government in 1937 for classifying industries. It was created in response to the problem of economists trying to compile data as a result of the Great Depression and realizing they had nothing much with which to work.

You can find SIC codes at sites such as...

https://www.osha.gov/pls/imis/sicsearch.html

or

http://www.naics.com/search/

NAICS: This is the North American Industry Classification System. you can find these numbers at the link above or at...

https://www.census.gov/eos/www/naics/

WEBSITE ADDRESS: The main website for your customer's business. If the business has more than one website, say a website for each product the company offers, you will want to indicate this in the remarks section later in the application.

EMAIL ADDRESS: This would be the email address at the business for the person working with you on the workers compensation application.

LEGAL ENTITY TYPE: Check the type of legal entity your customer uses. You will only check one type as these are mutually exclusive. If you are not certain, ask your customer.

CREDIT BUREAU NAME: I have actually never seen this filled in. This is the name of the specific credit bureau from whom the underwriter may choose to get a report. I have no idea how you would know this information.

ID NUMBER: This would be the ID number for this customer, but it is unclear whose ID number this would be - the carriers, your agency's, the credit bureaus? I would leave this blank.

FEDERAL EMPLOYER ID NUMBER: This is the Federal Tax ID number. It is in this format - 12-3456789. Ask your customer for this. They will have it.

NCCI RISK ID NUMBER: The National Council on Compensation Insurance number. If your customer is large enough to have a Workers Compensation experience rating modification, they will also have an NCCI number. This will mean they have had insurance for workers compensation. The number will be on their past policy.

If this is a new business, they will not have this number. Ask your underwriter about this. Let them help you with this input.

OTHER RATING BUREAU ID OR STATE EMPLOYER REGISTRATION NUMBER: Some states have their own ID numbers. Ask your underwriter for help. She will be vary familiar with the state by state issues for the states she underwrites.

That is a lot. You will not always fill out every single box with a response. Ask other agents in your office or your underwriter what information they need.

I hope this is helpful in teaching you how to complete the ACORD 130 Workers Compensation Application. Please share it with others.

Wednesday, April 23, 2014

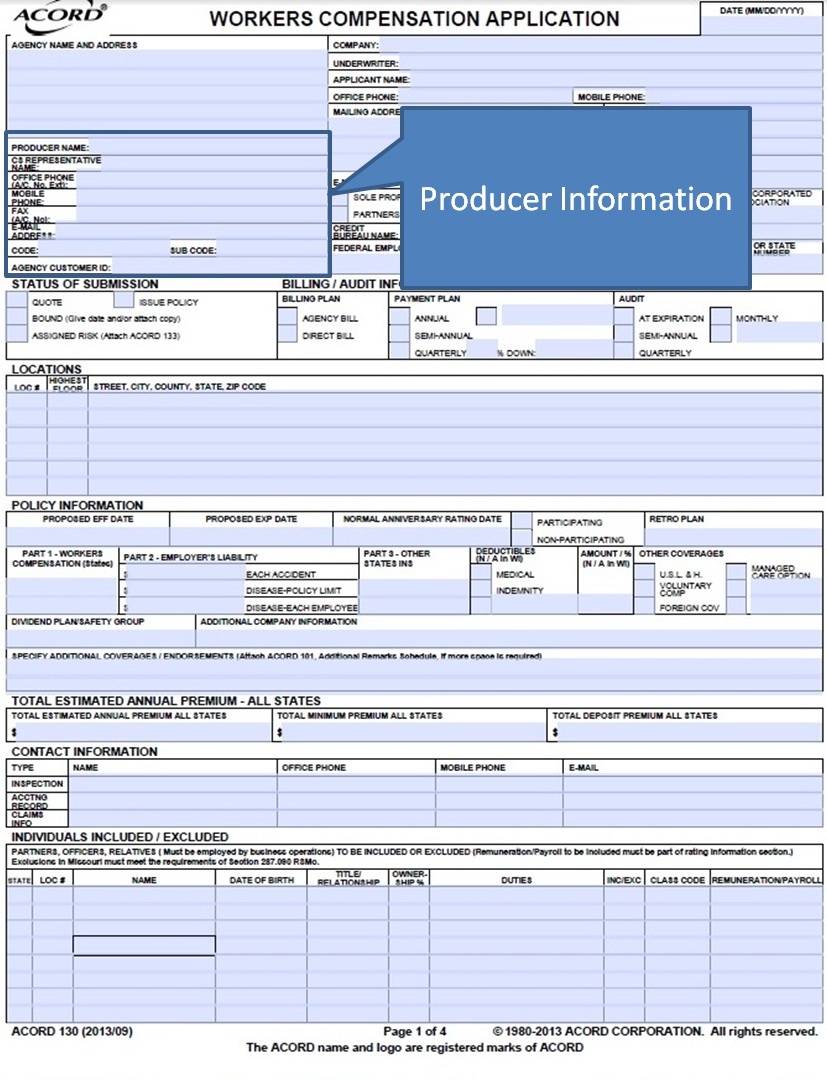

ACORD 130 Workers Compensation App Producer Infomation

Agent Information

Below your Agency's Name and Address, you enter your personal information.

This is for you the agent, producer, sales rep, account executive - whatever your agency calls you. You are the person the underwriter will be contacting to get more information and to return a quote. That is the main purpose of this section.

PRODUCER NAME: The agent to whom this account belongs.

CS REPRESENTATIVE NAME: This might be the same as Producer, in which case leave it blank or use dittos. Or it will be the name of the customer service rep who helps the producer with this account.

OFFICE PHONE: Your direct phone line, or main number if your agency has no individual direct lines.

MOBILE PHONE: The number for your business mobile phone. If you do not have a business mobile phone you should be certain your agency allows you to take business calls, get business emails and business text messages on your personal mobile phone before you give anyone that number.

It is a major cyber liability exposure for your agency to allow you to use a personal mobile device for business communications. If you ever leave your job at the agency, immediately, and without intent, you will have broken a number of privacy laws by having old business communications on your personal mobile device.

FAX: Your agency fax number if for some reason your agency still uses a FAX machine.

E-MAIL ADDRESS: This should be your business email. Follow the logic of using your personal mobile device above and the same applies to personal email addresses. It is a terrible idea for both you and your employer.

CODE: This is your agency code with the specific carrier to whom you are sending this application.

SUB CODE: This means sub-producer code. This is your individual sub producer code with this specific carrier. The reason for entering this is to make paying you commissions easier for your agency.

AGENCY CUSTOMER ID: This is the ID number assigned by some back office system somewhere. Maybe your agency back office system or the carrier back office system. This is probably left blank most of the time.

If you are using Cap Dat ACORD all this information will pre-fill this section from your profile.

I hope this helps you learn a bit more about how to complete the ACORD 130 Workers Compensation Application.

Please share this with anyone it may help.

Tuesday, April 22, 2014

ACORD 130 Workers Compensation Application - How to Complete the ACORD 130

The first section is so short, let's do two today.

This is the easy one. This is the date you are finished with the app and sending it to your underwriter.

This is your agency name, agency address for mailing purposes.

In Cap Dat ACORD this information is auto-filled from your agency profile.

So I guess both are easy.

We all learn things the first time at some point. I hope these short tutorials help you and your fellow workers become better at your job and profession.

DATE OF APPLICATION

This is the easy one. This is the date you are finished with the app and sending it to your underwriter.

AGENCY NAME AND ADDRESS

This is your agency name, agency address for mailing purposes.

In Cap Dat ACORD this information is auto-filled from your agency profile.

So I guess both are easy.

We all learn things the first time at some point. I hope these short tutorials help you and your fellow workers become better at your job and profession.

Monday, April 21, 2014

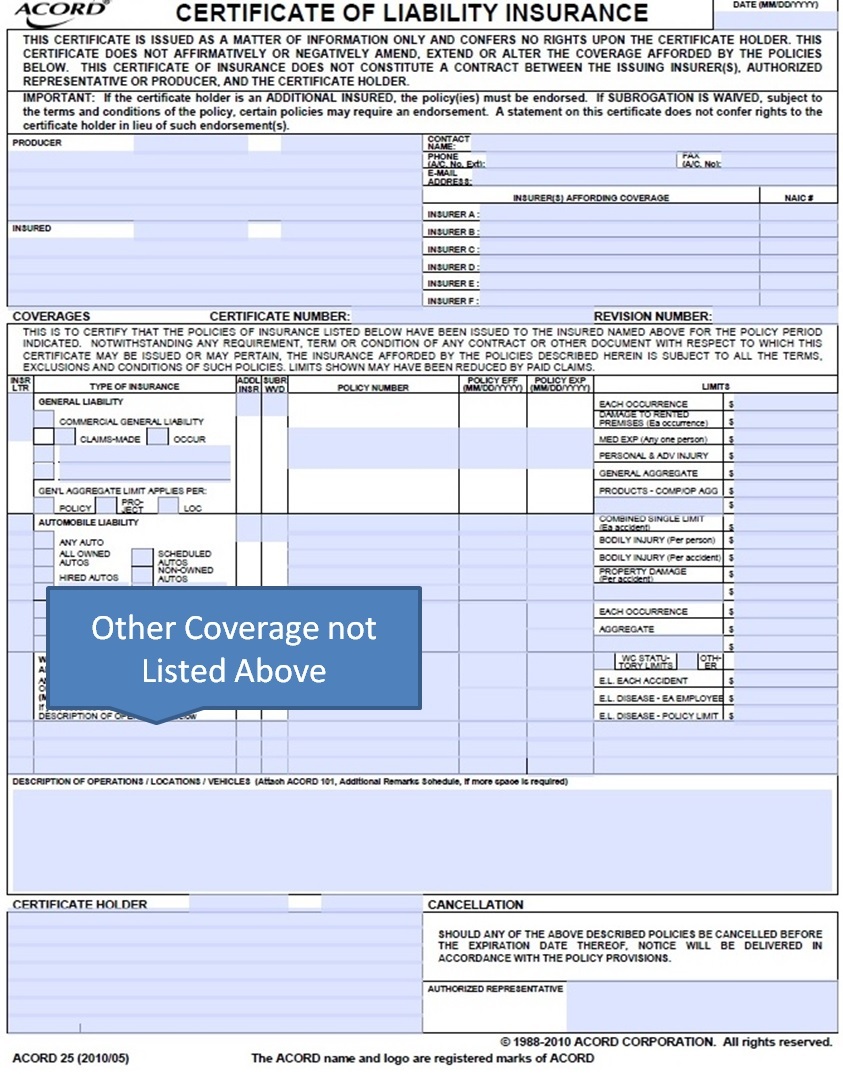

Table of Contents of all Post on How to Complete an ACORD 25 Certificate of Liability Insurance

For your convenience, here is a table of contents listing all posts on how to complete the ACORD 25.

First, here is a link to a YouTube video I did walking you though the process with a slightly older version of this form. Still useful...

http://simply-easier-acord-forms.blogspot.com/2009/07/how-to-fill-in-acord-25-certificate-of.html

Now, starting at the top of the form, I will show a picture of the form section and then a link to the post...

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-legal-notice-part-13-how-to.html

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-producer-information-part-10.html

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-producer-information-part-10.html

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-insured-information-part-11.html

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-insurer-letter-part-9-how-to.html

http://simply-easier-acord-forms.blogspot.com/2014/03/what-is-naic-code.html

http://simply-easier-acord-forms.blogspot.com/2014/03/details-in-acord-25-certificate-of.html

and

http://simply-easier-acord-forms.blogspot.com/2014/03/claims-made-vs-occurrence-definitions.html

http://simply-easier-acord-forms.blogspot.com/2014/03/acord-25-auto-liability-fields-how-to_25.html

and

http://simply-easier-acord-forms.blogspot.com/2014/03/acord-25-auto-liability-limits-how-to.html

http://simply-easier-acord-forms.blogspot.com/2014/03/acord-25-umbrella-and-excess-liability.html

http://simply-easier-acord-forms.blogspot.com/2014/03/acord-25-workers-comp-section-part-8-in.html

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-other-coverage-part-12-how-to.html

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-additional-insured-and-waiver.html

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-policy-number-and-dates-part.html

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-description-of-operations-part.html

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-certificate-holder-part-17-how.html

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-cancellation-notice-and.html

First, here is a link to a YouTube video I did walking you though the process with a slightly older version of this form. Still useful...

http://simply-easier-acord-forms.blogspot.com/2009/07/how-to-fill-in-acord-25-certificate-of.html

Now, starting at the top of the form, I will show a picture of the form section and then a link to the post...

Legal Notices

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-legal-notice-part-13-how-to.html

Producer Information

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-producer-information-part-10.html

Your Agent Information

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-producer-information-part-10.html

Insured Information

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-insured-information-part-11.html

Insurer Letter and Name

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-insurer-letter-part-9-how-to.html

NAIC Number

http://simply-easier-acord-forms.blogspot.com/2014/03/what-is-naic-code.html

Commercial General Liability

http://simply-easier-acord-forms.blogspot.com/2014/03/details-in-acord-25-certificate-of.html

and

http://simply-easier-acord-forms.blogspot.com/2014/03/claims-made-vs-occurrence-definitions.html

Automobile Liability

http://simply-easier-acord-forms.blogspot.com/2014/03/acord-25-auto-liability-fields-how-to_25.html

and

http://simply-easier-acord-forms.blogspot.com/2014/03/acord-25-auto-liability-limits-how-to.html

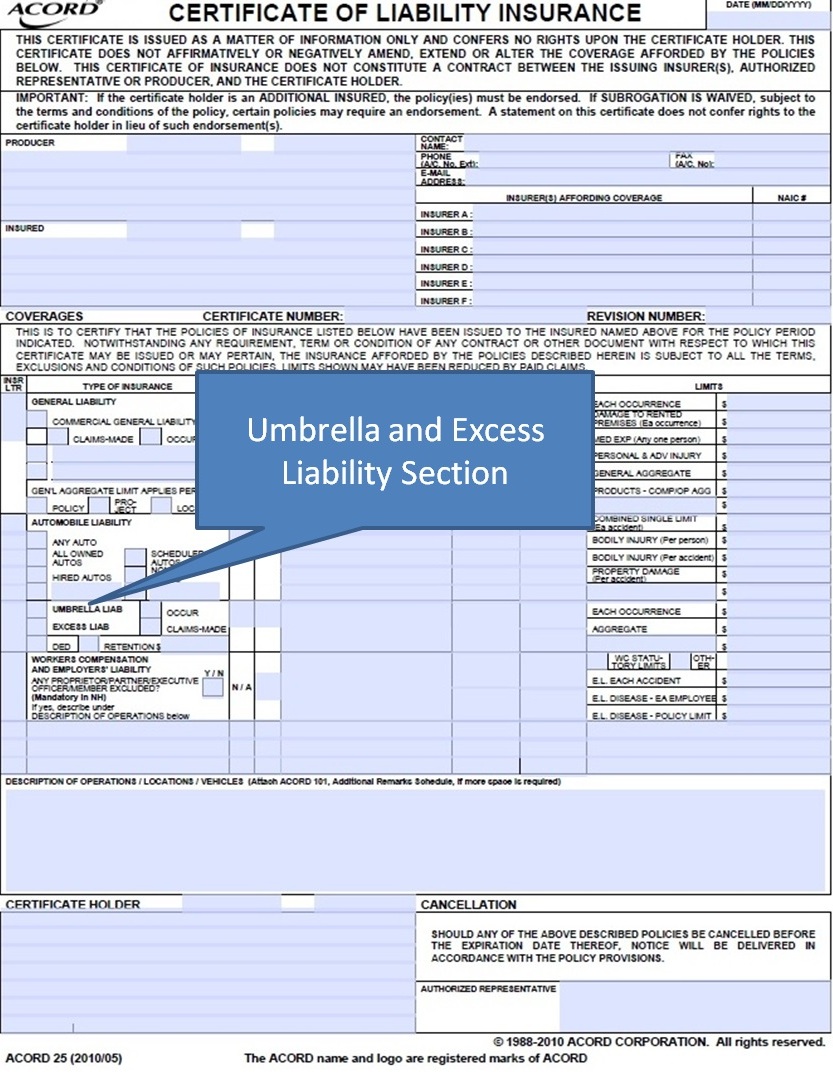

Umbrella and Excess Liability

http://simply-easier-acord-forms.blogspot.com/2014/03/acord-25-umbrella-and-excess-liability.html

Workers Compensation Section

http://simply-easier-acord-forms.blogspot.com/2014/03/acord-25-workers-comp-section-part-8-in.html

Other Coverage Section

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-other-coverage-part-12-how-to.html

Additional Insured and Waiver of Subrogation

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-additional-insured-and-waiver.html

Policy Number and Dates

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-policy-number-and-dates-part.html

Description of Operations

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-description-of-operations-part.html

Certificate Holder Section

http://simply-easier-acord-forms.blogspot.com/2014/04/acord-25-certificate-holder-part-17-how.html

Cancellation Notice and Signature

Thursday, April 17, 2014

ACORD 25 - Cancellation Notice and Signature - Part 18 How to Complete a Certificate of Liability Insurance

The bottom right hand corner of the ACORD 25 form has wording on cancellation notices and a space for an authorized signature.

The cancellation notice clearly states that cancellation notice will be delivered in accordance with the policy provisions.

Older ACORD 25 forms had a space for the number of days cancellation notice to be entered. This led to many problems.

Many Certificate Holders demand longer cancellation notices than the policies provide.

Policies typically provide the notice required by law for the specific state and coverage for which insurance is being provided.

If you must provide a longer notice of cancellation you must have the insurance carrier endorse the actual policy to provide this.

Never use the Description of Coverage to modify the length of the cancellation notice.

Often the request for a longer notice is because the certificate holder is looking at an old manual someone put together years ago for their business stating all certificates should have that length of notice. I suggest you talk to the person at the certificate holder office to see if this is the case and help them bring their manual up to date.

The final item is the AUTHORIZED REPRESENTATIVE signature.

A few insurance carriers insist that an employee of the carrier sign the certificate. Most carriers allow their licensed agents to sign. You need to be sure you are following the specific carrier's rules. Check with your underwriter.

I hope this is helpful. The intent is to guide you through each section of the certificate of liability insurance.

Please feel free to share this with anyone it may help.

The cancellation notice clearly states that cancellation notice will be delivered in accordance with the policy provisions.

Older ACORD 25 forms had a space for the number of days cancellation notice to be entered. This led to many problems.

Many Certificate Holders demand longer cancellation notices than the policies provide.

Policies typically provide the notice required by law for the specific state and coverage for which insurance is being provided.

If you must provide a longer notice of cancellation you must have the insurance carrier endorse the actual policy to provide this.

Never use the Description of Coverage to modify the length of the cancellation notice.

Often the request for a longer notice is because the certificate holder is looking at an old manual someone put together years ago for their business stating all certificates should have that length of notice. I suggest you talk to the person at the certificate holder office to see if this is the case and help them bring their manual up to date.

The final item is the AUTHORIZED REPRESENTATIVE signature.

A few insurance carriers insist that an employee of the carrier sign the certificate. Most carriers allow their licensed agents to sign. You need to be sure you are following the specific carrier's rules. Check with your underwriter.

I hope this is helpful. The intent is to guide you through each section of the certificate of liability insurance.

Please feel free to share this with anyone it may help.

Wednesday, April 16, 2014

ACORD 25 - Certificate Holder - Part 17 How to Complete a Certificate of Liability Insurance

The Certificate Holder Section is in the bottom left hand corner or the ACORD 25.

The Certificate Holder is the legal entity - usually a business or government - to whom the Insured is providing proof of insurance.

You should not only list the Entity's name and address. If you have a contact name, department name, email address and contact phone and/or fax number it is a good idea to list these also.

An example of this might be....

City of Mayberry

P.O. Drawer 17

Mayberry, NC 27710

ATTN: Bob Fossy

Dept of Roads

I hope this is helpful in your process of learning how to complete an ACORD 25 certificate of liability insurance.

We all learn things for the first time at some point. Please pass this along to other is may help.

The Certificate Holder is the legal entity - usually a business or government - to whom the Insured is providing proof of insurance.

You should not only list the Entity's name and address. If you have a contact name, department name, email address and contact phone and/or fax number it is a good idea to list these also.

An example of this might be....

City of Mayberry

P.O. Drawer 17

Mayberry, NC 27710

ATTN: Bob Fossy

Dept of Roads

I hope this is helpful in your process of learning how to complete an ACORD 25 certificate of liability insurance.

We all learn things for the first time at some point. Please pass this along to other is may help.

Tuesday, April 15, 2014

ACORD 25 - Description of Operations - Part 16 How to Complete a Certificate of Liability Insurance

The Description of Operations section is the large box above the Certificate Holder section.

This space is commonly used to limit or define the specific job for which a certificate is issued.

For example, your insured may need to provide a certificate when they win a bid to do a specific job for a city government. Let us say they won a bid to put in sidewalks on Elm St between Main and Oak streets. The description might read...

"Contract 1726-05 awarded April 2nd, 2014 with City of Durham for sidewalk construction on Elm St between Main St. and Oak St."

You should attempt to be this specific when possible.

Many certificates are required for longer term relationships and are re-issued at every renewal. In these cases the Description may be more general.

If you have listed the Certificate Holder as an Additional Insured you should be as specific and limiting as possible.

A common abuse and misuse of this section is to add wording that shows advance cancellation notification time periods or wording that seems to expand coverage. You should never do this. It is setting yourself up for an E&O claim.

I hope this is helpful in your process of learning how to complete the ACORD 25 certificate of liability insurance.

Please feel free to pass this along to others.

This space is commonly used to limit or define the specific job for which a certificate is issued.

For example, your insured may need to provide a certificate when they win a bid to do a specific job for a city government. Let us say they won a bid to put in sidewalks on Elm St between Main and Oak streets. The description might read...

"Contract 1726-05 awarded April 2nd, 2014 with City of Durham for sidewalk construction on Elm St between Main St. and Oak St."

You should attempt to be this specific when possible.

Many certificates are required for longer term relationships and are re-issued at every renewal. In these cases the Description may be more general.

If you have listed the Certificate Holder as an Additional Insured you should be as specific and limiting as possible.

A common abuse and misuse of this section is to add wording that shows advance cancellation notification time periods or wording that seems to expand coverage. You should never do this. It is setting yourself up for an E&O claim.

I hope this is helpful in your process of learning how to complete the ACORD 25 certificate of liability insurance.

Please feel free to pass this along to others.

Monday, April 14, 2014

ACORD 25 - Policy Number and Dates - Part 15 How to Complete a Certificate of Liability Insurance

In the center of the ACORD 25 form, in the COVERAGES section are three columns titled POLICY NUMBER, POLICY EFF (MM/DD/YYYY), and POLICY EXP (MM/DD/YYYY).

For each COVERAGE TYPE - Commercial General Liability, Automobile Liability, Umbrella and Excess, Workers Compensation, and other you will enter the specific policy number for that coverage type in the column titled POLICY NUMBER.

Include any policy number prefix - such as BAP or WC. Enter any policy number suffix such as 01 or 02. Your policy number might look something like this....

WC-1075998-04

Generally the prefix indicates line of business and the suffix indicates consecutive policy term.

Under the column titled POLICY EFF, enter the effective date of the policy. The requested format of MM/DD/YYYY means two digits for month, two digits for day of the month and four digits for year.

Examples would be 01/01/2014 or 11/15/2014. Use a leading 0 for months and dates less than 10.

The reason for this formatting is to standardize the input for computer systems. If you enter using the requested format you help eliminate errors in the process.

Under the column titled POLICY EXP, enter the policy's expiration date. The comments above about effective date apply to expiration date.

I hope this information is helpful in your learning how to complete the ACORD 25 certificate of liability insurance.

We all learn for the first time at some point. Please feel free to pass this on to others you think it may help.

For each COVERAGE TYPE - Commercial General Liability, Automobile Liability, Umbrella and Excess, Workers Compensation, and other you will enter the specific policy number for that coverage type in the column titled POLICY NUMBER.

Include any policy number prefix - such as BAP or WC. Enter any policy number suffix such as 01 or 02. Your policy number might look something like this....

WC-1075998-04

Generally the prefix indicates line of business and the suffix indicates consecutive policy term.

Under the column titled POLICY EFF, enter the effective date of the policy. The requested format of MM/DD/YYYY means two digits for month, two digits for day of the month and four digits for year.

Examples would be 01/01/2014 or 11/15/2014. Use a leading 0 for months and dates less than 10.

The reason for this formatting is to standardize the input for computer systems. If you enter using the requested format you help eliminate errors in the process.

Under the column titled POLICY EXP, enter the policy's expiration date. The comments above about effective date apply to expiration date.

I hope this information is helpful in your learning how to complete the ACORD 25 certificate of liability insurance.

We all learn for the first time at some point. Please feel free to pass this on to others you think it may help.

Friday, April 11, 2014

ACORD 25 - Additional Insured and Waiver of Subrogation Indicators - Part 14 How to Complete a Certificate of Liability Insurance

About a third of the way from the left hand side of the COVERAGE section, next to the TYPES OF INSURANCE are two columns labeled ADDL INSD and SUBR WVD.

For each applicable coverage type you should put a check mark in the box for Additional Insured if the certificate holder on this policy is also listed as an Additional Insured on the actual policy. It is important to note if you check this box and the actual policy does not show the certificate holder listed as an Additional Insured, checking this box has not made that coverage available. It may have, however, made you and your agency open to an E&O claim over that error.

An Additional Insured is a person or legal entity which is not included as a Named Insured under the Policy Definitions, but is added by endorsement to the policy to be an insured. A more complete definition is available from IRMI.

For each applicable coverage type if the policy includes a Waiver of Subrogation you should put a check mark in the box labeled SUBR WVD.

Subrogation is the assignment of the insured's rights to collect the amount of a loss from the liable party from the Named Insured to the insurance carrier for the coverage type.

Subrogation can be waived by endorsement to the actual policy. Be certain the polciy has been endorsed if you check this box.

I hope this helps you learn how to complete an ACORD 25 certificate of liability insurance.

For each applicable coverage type you should put a check mark in the box for Additional Insured if the certificate holder on this policy is also listed as an Additional Insured on the actual policy. It is important to note if you check this box and the actual policy does not show the certificate holder listed as an Additional Insured, checking this box has not made that coverage available. It may have, however, made you and your agency open to an E&O claim over that error.

An Additional Insured is a person or legal entity which is not included as a Named Insured under the Policy Definitions, but is added by endorsement to the policy to be an insured. A more complete definition is available from IRMI.

For each applicable coverage type if the policy includes a Waiver of Subrogation you should put a check mark in the box labeled SUBR WVD.

Subrogation is the assignment of the insured's rights to collect the amount of a loss from the liable party from the Named Insured to the insurance carrier for the coverage type.

Subrogation can be waived by endorsement to the actual policy. Be certain the polciy has been endorsed if you check this box.

I hope this helps you learn how to complete an ACORD 25 certificate of liability insurance.

Thursday, April 10, 2014

ACORD 25 - Legal Notice - Part 13 How to Complete a Certificate of Liability Insurance

At the very top of the ACORD 25 Certificate of Liability Insurance There are two sections of legal notices.

THESE ARE INCREDIBILITY IMPORTANT

The first notice states the certificate is not the policy and does not amend the policy. To protect yourself from E&O exposures you need to keep this in mind when you put information into the form. Of particular concern should be what goes into the Description of Operation section. Be certain you do not use wording that could be seen as expanding or modifying the coverage of the policy contract.

The Second notice warns about showing the certificate holder as an Additional Insured or showing Subrogation as Waived. You need to be certain your actual policy is amended to track the certificate for these two items.

I will discuss these two items in the very next post.

As always, this is not a court room explanation, but basic information to help you understand how to complete the ACORD 25.

We all learn for the first time at some point. I hope this is helpful to you in learning how to complete a certificate of liability insurance.

THESE ARE INCREDIBILITY IMPORTANT

The first notice states the certificate is not the policy and does not amend the policy. To protect yourself from E&O exposures you need to keep this in mind when you put information into the form. Of particular concern should be what goes into the Description of Operation section. Be certain you do not use wording that could be seen as expanding or modifying the coverage of the policy contract.

The Second notice warns about showing the certificate holder as an Additional Insured or showing Subrogation as Waived. You need to be certain your actual policy is amended to track the certificate for these two items.

I will discuss these two items in the very next post.

As always, this is not a court room explanation, but basic information to help you understand how to complete the ACORD 25.

We all learn for the first time at some point. I hope this is helpful to you in learning how to complete a certificate of liability insurance.

Friday, April 4, 2014

ACORD 25 - Other Coverage - Part 12 How to Complete an ACORD 25 Certificate of Liability Insurance

There is a blank section at the bottom of the coverage section to allow you to enter types of insurance that are not commercial general liability, automobile liability, umbrella or excess liability or workers compensation.

Types of coverage you may enter her might be Boiler Steam, Aircraft, Longshoremen's, etc.

The point is, this form can be used for coverage that requires a certificate of insurance by a certificate holder.

I hope this is helpful in learning how to complete an ACORD 25 certificate of Liability Insurance.

Types of coverage you may enter her might be Boiler Steam, Aircraft, Longshoremen's, etc.

The point is, this form can be used for coverage that requires a certificate of insurance by a certificate holder.

I hope this is helpful in learning how to complete an ACORD 25 certificate of Liability Insurance.

Thursday, April 3, 2014

ACORD 25 - Insured Information - Part 11 How to Complete an ACORD 25 Certificate of Insurance

The INSURED section of the ACORD 25 is where you enter the Insured's Name and Address as it is required to appear by the certificate holder.

I hope this is helpful.

It may seem basic, but we all learn for the first time at some point. I want to be thorough in providing information.

I hope this is helpful.

It may seem basic, but we all learn for the first time at some point. I want to be thorough in providing information.

Wednesday, April 2, 2014

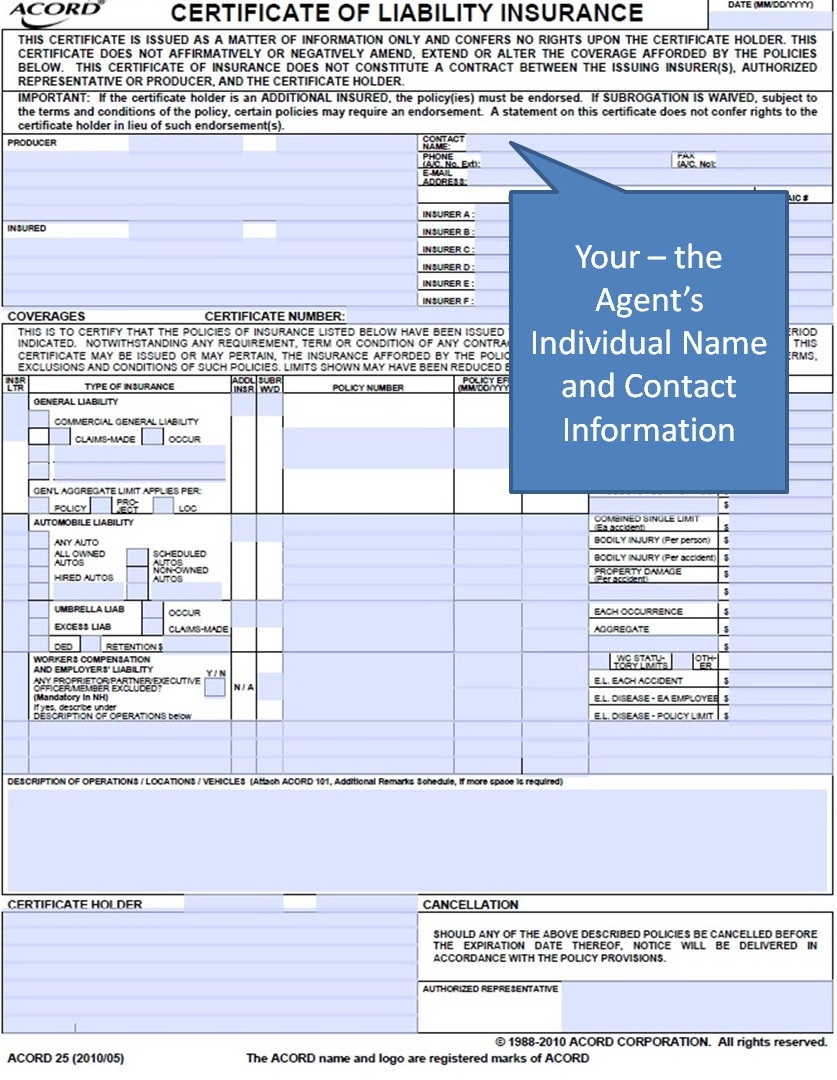

ACORD 25 - Producer Information - Part 10 - How to Complete an ACORD 25 Certificate of Liability Insurance

The Producer information section in the top left hand corner of the ACORD 25 is where you enter your agency's name and address.

The contact section to the right of the PRODUCER section is where you enter your - the individual agent's - name, phone number, email and fax.

I hope this is helpful to you in learning how to complete the ACORD 25 Certificate of Liability Insurance form.

The contact section to the right of the PRODUCER section is where you enter your - the individual agent's - name, phone number, email and fax.

I hope this is helpful to you in learning how to complete the ACORD 25 Certificate of Liability Insurance form.

Tuesday, April 1, 2014

ACORD 25 - Insurer Letter - Part 9 How to Complete an ACORD Certificate of Liability Insurance Form

You enter the Insurer's name on the line labeled Insurer A, Insurer B, etc.

I hope this is helpful. We all learned things for the first time at some point. I hope this helps you in filling out an ACORD 25 Certificate of Liability Insurance.

On the far left hand column under COVERAGES section there is a column titled INS LTR.

Enter the correctly matching Insurer letter from the INSURER(S) AFFORDING COVERAGE section into this column next to the appropriate TYPE OF INSURANCE.

I hope this is helpful. We all learned things for the first time at some point. I hope this helps you in filling out an ACORD 25 Certificate of Liability Insurance.

Subscribe to:

Posts (Atom)